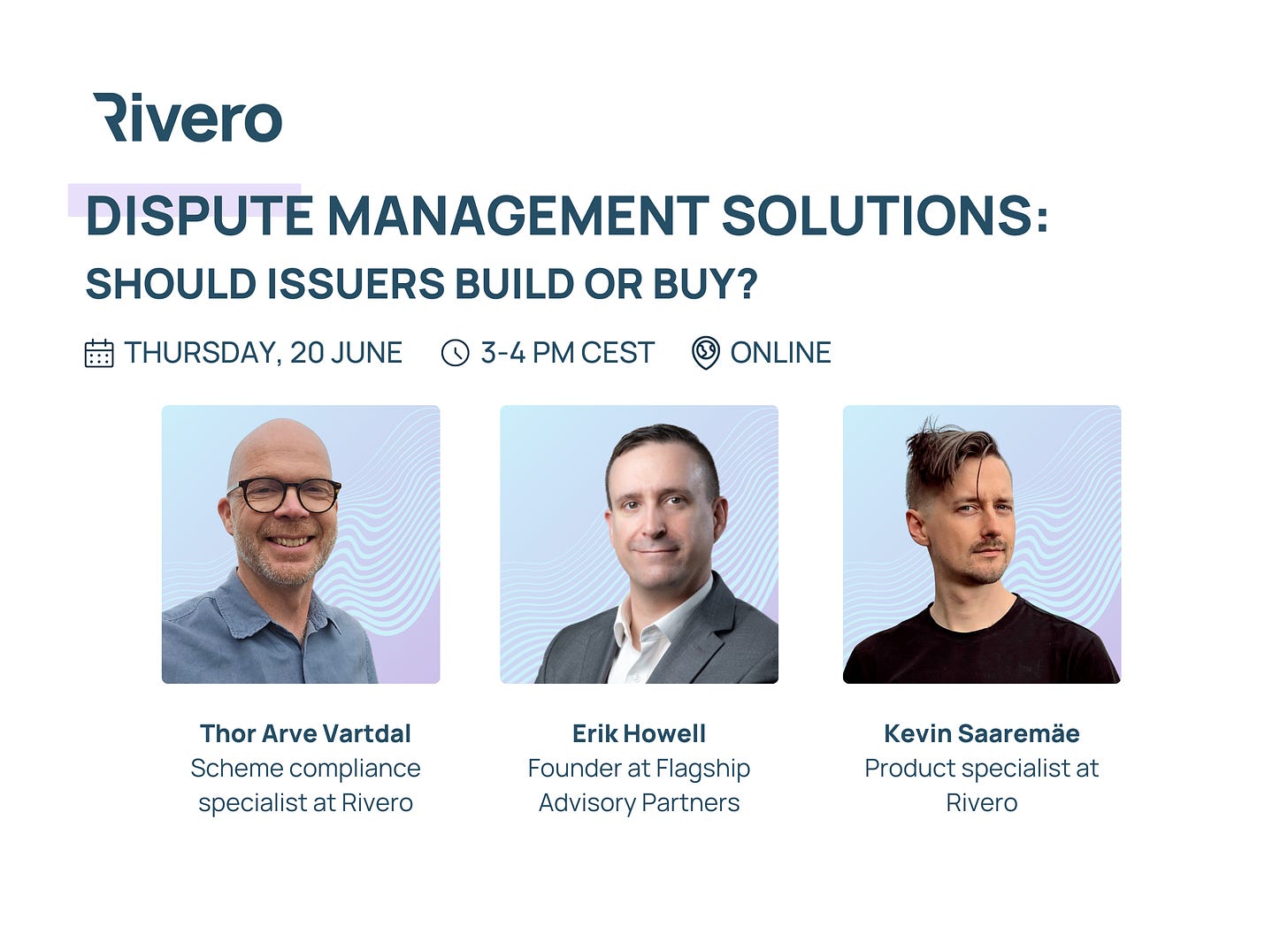

Deciding whether to build an in-house dispute management tool or to buy an established system is pivotal for any financial institution today. Join us on June 20 at 15:00 CEST for our webinar, "Dispute Management Solutions: Should Issuers Build or Buy?" and gain insights from industry experts on what’s best for your bank.

Meet the experts

Thor Arve Vartdal: Thor brings 28 years of experience in the card payments industry, including 12 years with an international card scheme and extensive experience with various processors on both the issuing and acquiring sides. His career has spanned both operational roles and product development.

Erik Howell: Erik brings 23 years of experience in payments and fintech, with expertise in payments issuing, embedded finance, and banking. His career has spanned roles in market expansion, strategic development, and client advisory. At Flagship Advisory Partners, Erik advises clients on growth strategies and Mergers and Acquisition.

Kevin Saaremäe: Kevin has seven years of experience in card fraud and disputes, spanning operations, compliance, and project management. He possesses a deep understanding of card scheme rules and industry-standard practices, as well as firsthand experience in solving the challenges of creating effective internal tools. Kevin's background covers both the issuing and acquiring sides of the industry.

What we'll cover

Dispute management and why it matters

Challenges banks face with their dispute management process

Building vs buying: key factors to consider

The hidden costs of in-house customisation

Protecting data privacy

Balancing customer experience with dispute volume management

Don’t miss out on the opportunity to gain expert insights that could significantly influence your strategic decisions regarding dispute management.

We look forward to welcoming you to what promises to be a thought-provoking and informative session.