According to new studies by Ethoca, Verifi and Datos Insights, Chargebacks continue to roil the global financial ecosystem. Charting an uptick in fraud and first-party misuse (FPM), the reports examine trends in dispute management and consumer behaviour.

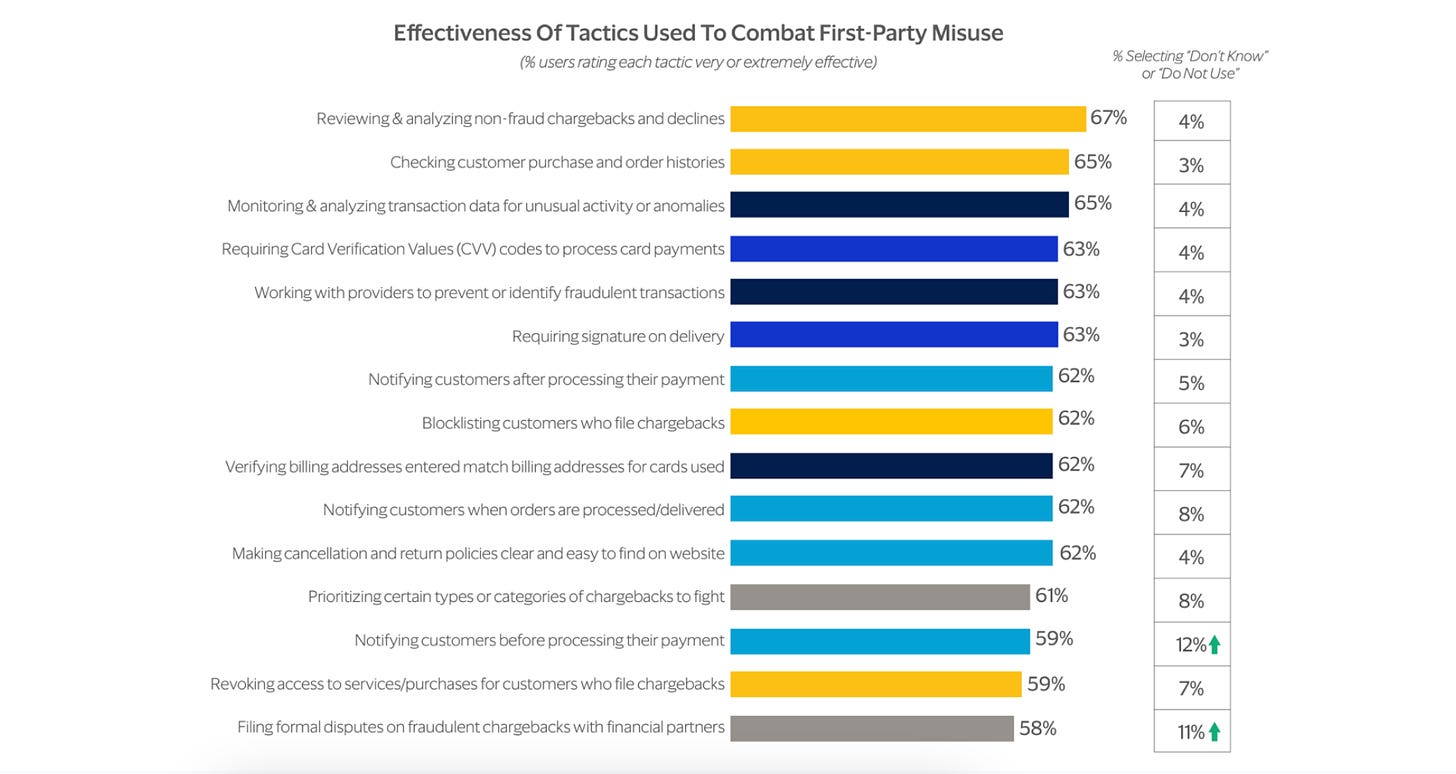

Ethoca’s 2024 Outlook: Strategic insights for issuers and merchants, cited refund/policy abuse and first-party misuse (FPM) as top fraud trends in 2023, noting that both involve post-purchase efforts by customers or fraudsters to obtain free goods or services. Researchers found merchants use multiple tools throughout the transaction lifecycle to mitigate these disputes. For example, 67% of the 1,166 merchants surveyed routinely review and analyse non-fraud chargebacks to counter FPM, and 65% look for unusual patterns in customer order histories.

Consistent with Ethoca’s findings, the 2024 Global eCommerce Payments & Fraud Survey, produced by the Merchant Risk Council, Verifi, and Visa Acceptance Solutions, named refund/policy abuse and first-party misuse as the top two threats in 2022 and 2023, with FPM rapidly rising. Based on a survey of over 1,100 merchants in North America, Europe, Latin America, and Asia-Pacific regions, the report indicated that merchants reject approximately 6% of e-commerce orders due to fraud concerns, leading to false positive rates of between 2% and 10% and win rates of below 20% on fraud-related cardholder disputes.

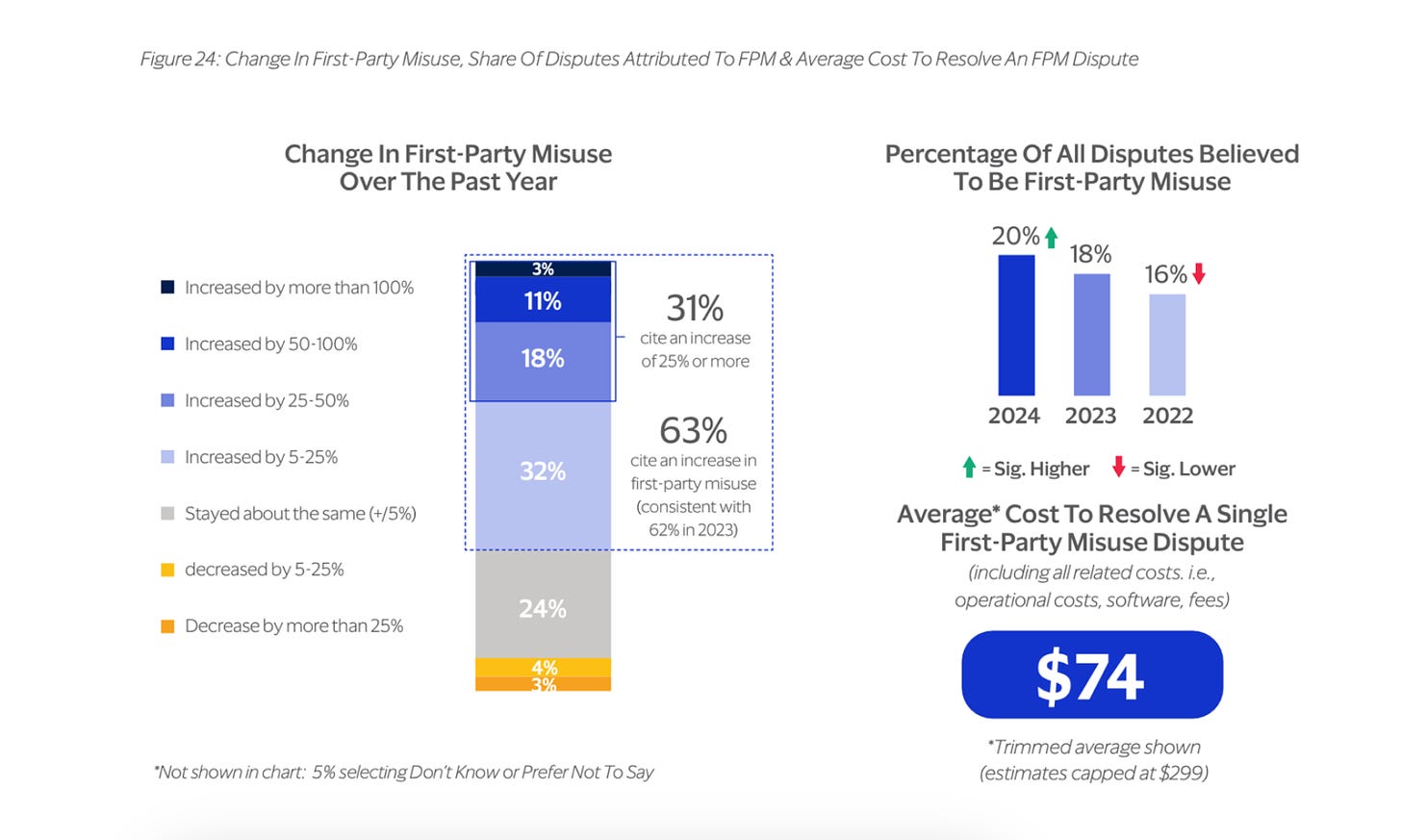

“For the second consecutive year, more than 60% of merchants in the survey say they experienced an increase in FPM over the past 12 months,” researchers wrote, noting that 31% of survey respondents had seen 25% more FPM fraud in the past year alone. These findings provide further evidence of FPM’s meteoric rise from 16% in 2022 to 20% this year, they noted.

Fast, Frictionless Dispute Management

Datos Insights reported that 84% of consumers will contact a bank first to resolve a transaction issue. “Half of consumers who didn’t recognise a purchase transaction contacted their bank while over 35% requested a refund from their bank or card issuer,” researchers wrote, urging organisations to implement more cost-effective approaches to customer service, as each live service interaction can cost more than $7 USD.

Ethoca researchers pointed out that customers appreciate the ease and efficacy of opening a claim with an issuing bank and will continue to use this financial tool. Banks need to meet these claims in near real-time, they stated, by providing customers with self-service tools at all points of interaction. Chatbots on websites and banking apps can provide rich transaction data to customers in a friendly way to address and resolve complaints and inquiries.

“These improvements influence an issuer’s Net Promoter Score® and Customer Satisfaction Score (CSAT) — underscoring the importance of [prioritising] the customer experience,” researchers wrote. “Providing more information via text, email, chatbots or by phone is helpful, but many consumers seek out reviewing their transaction details in their digital banking app. Extending your brand’s presence and making information available in multiple places, like a digital bank app, helps reduce transaction confusion and potential disputes upfront.”

Simple Self-Service Dispute Management

Ethoca researchers pointed out that customers appreciate the ease and efficacy of opening a claim with an issuing bank and will continue to use this financial tool. Banks can offer self-service options at all points of interaction, they suggested, through chatbots and banking apps that provide rich transaction data to address and resolve customer complaints and inquiries.

“These improvements influence an issuer’s Net Promoter Score® and Customer Satisfaction Score (CSAT) — underscoring the importance of [prioritising] the customer experience,” researchers wrote. “Providing more information via text, email, chatbots, or phone is helpful, but many consumers seek out reviewing their transaction details in their digital banking app. Extending your brand’s presence and making information available in multiple places, like a digital bank app, helps reduce transaction confusion and potential disputes upfront.”

Ethoca researchers acknowledged that not all first-party disputes are intentionally fraudulent. For example, a cardholder may not recognise a charge or be aware of a friend or family member’s unauthorised purchase. Issuers and merchants can share additional data elements, such as purchase history, device, delivery information, identity elements, and geolocation to resolve issues stemming from unintentional first-party fraud.

Multiple Tools Needed

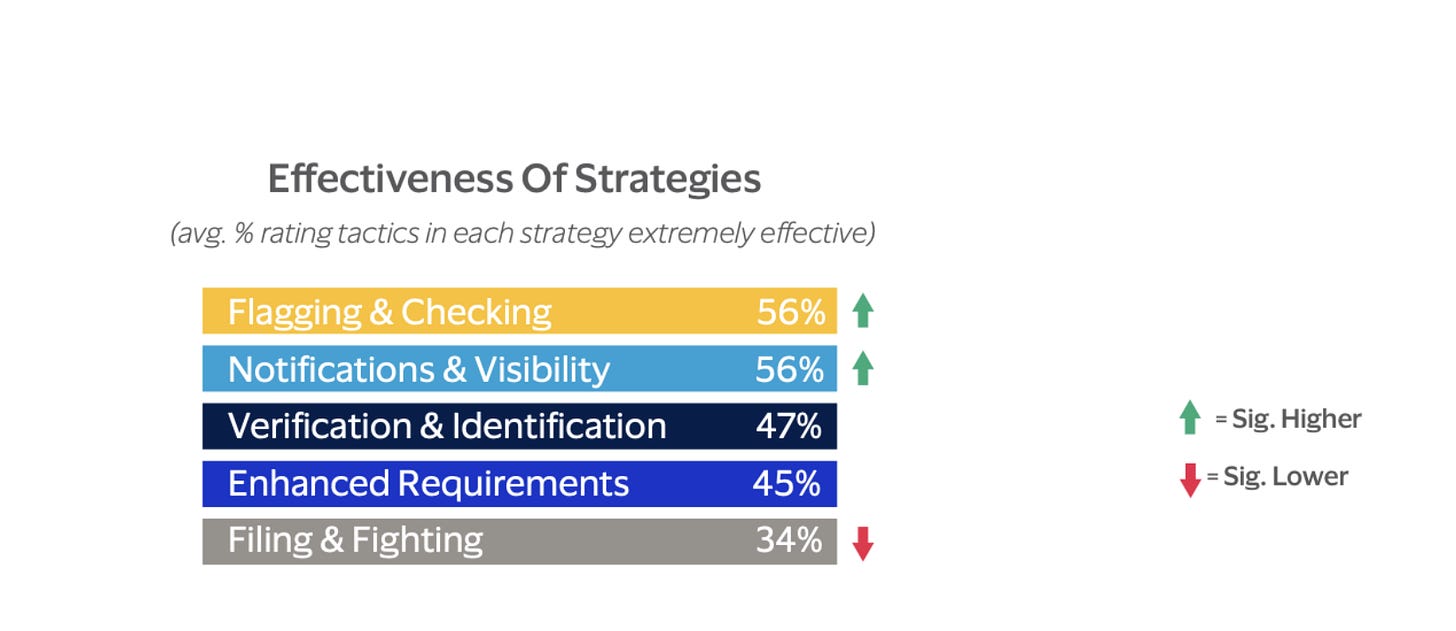

Verifi researchers assessed a variety of strategies to combat first-party misuse and found “flagging and checking” and “notifications and visibility” more effective than “fighting and filing.” In fact, fewer than 35% of survey respondents had success with fighting and filing.

“These data show merchants view reviewing and [analysing] non-fraud chargebacks as the most effective single tactic for countering FPM, closely followed by checking customer purchase and order histories and monitoring transaction data for unusual patterns,” Verifi researchers wrote. “Requiring CVV values to process card payments and working with providers to jointly prevent or identify fraudulent transactions round out the top five.”

Ethoca researchers agreed that implementing multiple tools can minimise fraud, identify good customers throughout the purchase journey, and increase authorisation rates. “Consider building a better cardholder experience that makes it easier to recognize transaction details,” they wrote. “Offer digital self-serve features that will put more information and control at consumers’ fingertips.”

Enhance Automated Scheme Solutions

Ethoca predicted that different regions will experience varying chargeback growth rates until more countries mandate strong customer authorisation (SCA) tools. “Disputes and chargebacks will grow as consumers increasingly make purchases using smartphones in-store, online and with mobile apps,” researchers wrote. “Global chargeback volume is projected to reach 337 million transactions in 2026, a 42% increase from 2023 levels.”

Rivero’s virtual agent, Amiko, can help issuers meet these growing case volumes, working hand-in-hand with Mastercom and VROL to manage disputes and arbitrations across the entire dispute lifecycle. Using curated chatbot skills, Amiko communicates with cardholders online and in apps and portals. Its digital skills and rule-based AI capabilities optimise efficiencies and reduce human error across case creation, merchant collaboration, and fraud reporting.

Ethoca researchers acknowledged that not all first-party disputes are intentionally fraudulent. For example, a cardholder may not recognise a charge or be aware of a friend or family member’s unauthorised purchase. Issuers and merchants can share additional data elements, such as purchase history, device, delivery information, identity elements, and geolocation, issuers and merchants to resolve issues stemming from unintentional first-party fraud.

As issuers, merchants, cardholders, and third-party service providers continue to navigate disputes across multiple channels and geographic regions, balancing dispute management with optimal customer experiences will foster relationships based on respect, profitability, and trust.

Make Chargebacks a Last Resort

Leveraging rule-based chatbots and automated technologies to resolve cardholder inquiries before initiating a chargeback is crucial in addressing issues with FPM. These solutions can provide transactional data to cardholders who may question billing descriptors or unclear charges and can answer simple questions before these concerns escalate into formal chargeback cases.

Additionally, rule-based chatbots can guide cardholders to contact the merchant directly for a refund, rather than immediately filing a formal complaint. A chargeback should be the last resort, only when no other alternatives are available.

Pre-dispute collaboration platforms like Ethoca (by Mastercard) and Verifi (by Visa) also enable transactions to be refunded directly by the merchant, avoiding the need for a chargeback altogether.

Rivero’s dispute management solution, Amiko, combines the power of rule-based chatbots with the collaboration platforms of Ethoca and Verifi. This allows issuers to prevent or resolve unjustified cardholder disputes or refund requests from merchants before escalating to the chargeback process.

As issuers, merchants, cardholders, and third-party service providers continue to navigate disputes across multiple channels and geographic regions, balancing dispute management with optimal customer experiences will foster relationships based on respect, profitability, and trust.

Related articles: