Solving the complex issue of first-party fraud has been a top concern for issuers and merchants. Also known as friendly fraud, these events occur when customers dispute their own transactions, for reasons ranging from unrecognised transactions, misuse of their payment credentials by others, and other service-related issues. Recent studies indicate that first-party fraud is rising, heightening the risk of false declines for issuers and chargebacks for merchants.

Mastercard attributed the rise of friendly fraud to converging trends, such as the growing adoption of e-commerce and digital payments, “transaction confusion” when consumers do not recognise descriptions on billing statements, and a growing population of connected devices with stored payment credentials where people other than authorised users can initiate purchases.

“When it comes to fighting friendly fraud, it’s critical that merchants and issuers work together to put more clarity and information at customers’ fingertips—before they decide to dispute a legitimate charge,” Mastercard wrote, advising that clearly displayed merchant names and logos can provide useful insights to customers and customer service representatives.

Time, Money, Effort

Mastercard described dispute management as time-consuming, labour-intensive and costly. Issuers may turn away a legitimate dispute, creating a false decline that results in reputational damage and revenue losses. Merchants may file a report and fight a dispute, only to see it become a chargeback requiring additional fees and refunds. Customers may file a legitimate dispute, only to become unhappy by lengthy questionnaires and time delays.

These difficulties further impact the bottom line and customer experience, according to the 2024 Global Payments and Fraud Report, published by The Merchant Risk Council (MRC), Cybersource, and Verifi, which called first-party fraud a growing issue for 6 in 10 merchants, fueled by “attempts to obtain free goods and transaction descriptor confusion.”

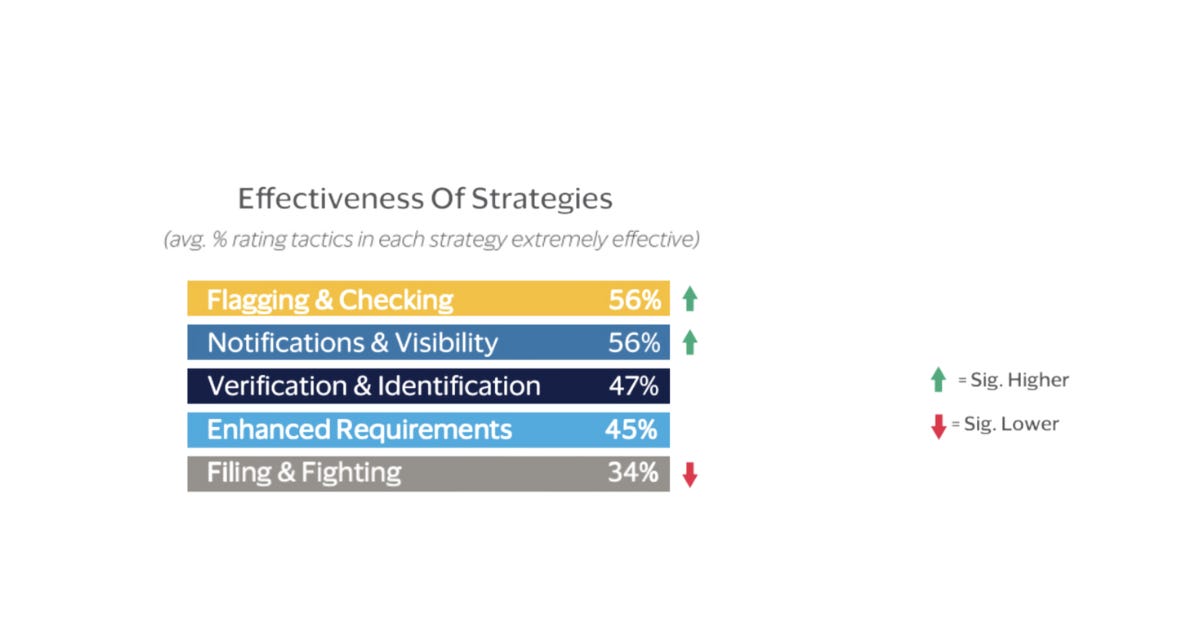

Researchers identified five strategic approaches that merchants around the world use to combat first-party misuse (FPM):

Flagging and checking;

Notifications and visibility;

Verification and identification;

Enhanced requirements

Filing and fighting, which most survey respondents admittedly used with limited success.

MRC survey respondents ranked “flagging and checking transactions,” and “notifications and visibility” as top strategies for reducing FPM.

Immediate, Cost-Efficient, Effortless

Ethoca advised issuers to include merchant names, logos, and digital receipts in transaction details, and to share information quickly to help customers recognise charges on billing statements.

Considering the time, effort, and human capital required to manage first-party fraud disputes, wouldn’t it be preferable to stop disputes before they happen, by automating strategies and recommendations? Domain-specific chatbots can address customer inquiries in various languages, using card network rules while providing customer-requested information and transaction details on demand. In fact, Rivero recently disclosed that Amiko’s Virtual Agent successfully deflected 80% of first-party fraud claims without human assistance.

Protect Revenue, Restore Trust

Fatemeh Nikayin, co-founder of Rivero, noted that first-party fraud is not always intentional. “A customer may open a banking app and see an unfamiliar transaction on a card that is used on a daily basis,” she said. “If the app displays only a misleading merchant’s name and amount billed, it might be difficult for the customer to recall a month-old transaction.”

Unintentional first-party fraud, also known as family or friendly fraud, may occur on smartphones and connected devices, she added, providing the example of a child buying a game on a parent’s phone. In cases like these, Virtual Agents can curate and share contextual data from authorisation flows to help family members recognise a transaction’s specific details and provenance.

Whether willful or unintentional, first-party disputes can be managed at scale by Amiko’s Virtual Agent, Nikayin explained, which outperforms legacy dispute software. With deep knowledge of scheme rules and ability to aggregate fraud-related transactions into a single case, Amiko’s Virtual Agent can be integrated into banking apps via APIs to provide banks’ customers with self-service options.

Zero-Touch First-Party Fraud Deflection

When a cardholder clicks a button, effectively claiming to not recognise a transaction, Amiko’s Virtual Agent responds immediately, initiating a conversation in the customer’s native language and fetching pertinent details, such as the location, time, currency, and digital platform where a transaction occurred. Beyond providing information quickly, the chatbot is personable and responsive to basic questions, without involving a customer service representative at the bank.

Unlike traditional exchanges between a customer and a card issuer, no humans are involved. Customers do not have to call a bank, only to be referred to an agent, who would then have to research the transaction further. The virtual agent can ask the cardholder relevant questions and provide all the information needed to remember or recognise the transaction in question: a truly zero-touch first-party fraud deflection before cases are even opened.

By providing access to transaction data wherever and whenever customers need it, deflecting false claims and chargebacks, and improving issuer efficiencies, zero-touch fraud resolution deflects first-party fraud at the start, benefitting the entire commerce value chain.

Related articles:

Reimagining Dispute Resolution: Strengthen Customer Relationships and Cut Costs

The Case for Always-On, Always-Connectected Dispute Management

See firsthand how our SaaS products have fueled success for our clients

Rivero in the news: our latest press releases

Related podcasts: