Six Pillars of Dispute Management

Thor Arve Vartdal, scheme compliance expert at Rivero, observed that digital operational resilience is a driving force in modern dispute management, as it continues to evolve from basic efforts to shorten dispute cycles into complex, data-driven interactions. “I’ve been working with compliance, fraud, and disputes for quite a few years, on both the issuing and acquiring side,” he said. “Optimising disputes is not new; 20 years ago, Visa had a project called Red, which stands for re-engineering disputes, with the objective of shortening debates between issuers and acquirers about which party is liable for a dispute. But dispute management is so much more than that.”

In our “Mastering Dispute Management” webinar (hosted on September 2024), Vartdal explored industry trends with Ben Beer, senior consultant, dispute optimisation at Visa. Beer noted that disputes had leveled off following the pandemic but have begun to rise again and 75% of current dispute traffic is fraudulent. “We’re paying a high price for disputes across the European region,” Beer said. “The Visa network processed around 10 million disputes worth, roughly $928 million in 2023, and European volumes may cross a billion relatively soon, because we had an increase of 8% between 2021 and 2023.”

Beer went on to say that organizations are beginning to evaluate the operational costs of dispute management, citing the following six pillars of effective dispute processing:

Monitoring and Compliance: Monitor disputed transactions for accuracy and monitor cardholders to prevent abuse.

Systems: Evaluate how dispute management system workflows, including VROL compliance, updates, inputs and degree of efficiency.

Reporting: Capture data that highlights processes, areas in need of improvement, dispute frequencies and outcomes. Follow the incoming and outgoing money trail.

Overall performance: Compare your organisation’s dispute management effectiveness and related costs with other countries and regional benchmarks.

Workflow: Assess available inputs, or dispute channels to determine how they work, how each channel is monitored and respective levels of efficiency.

Knowledge: Review staff training protocols, determine each associate’s level of knowledge, access and awareness of rules, and ability to keep everyone up to date with rules and compliance guidelines.

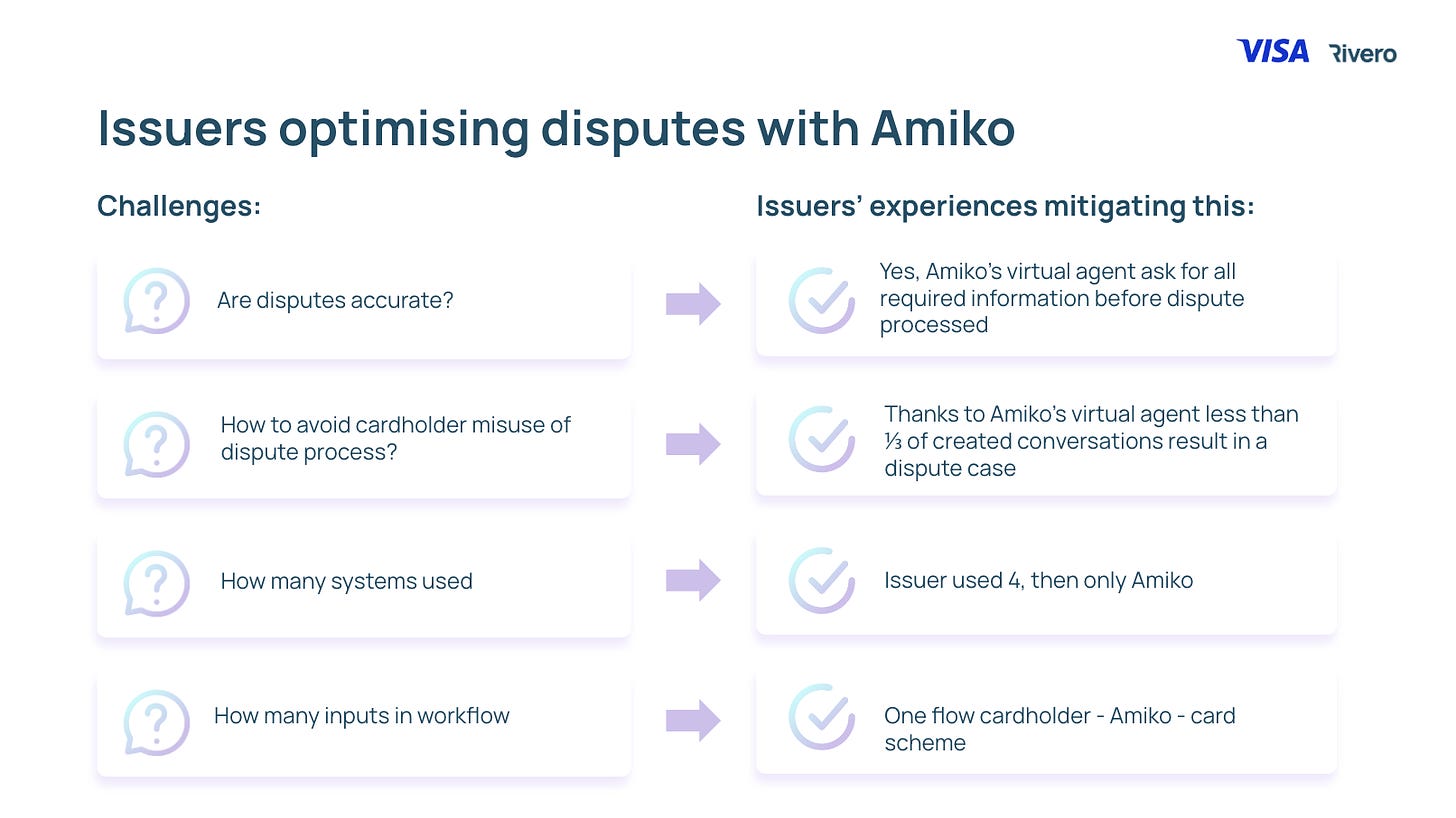

Beer stated that he has seen some issuers’ team members use up to five or six applications to manage a single dispute. It may begin with a customer emailing a form, which requires Outlook. Then the form needs to be scanned, which requires document imaging, and subsequently uploaded to a CRM, such as Salesforce. After raising the incident as a dispute through Visa Resolve Online (VROL), the transaction may also require research in a different application, such as a fraud prevention tool or solution. In this example, the organisation used six different applications to process a single dispute.

Vartdal noted that Amiko could replace all such side applications and enable issuers to manage the entire dispute from initial inquiry and case management to resolution in Amiko. “We have received feedback from issuers who have doubled their capacity to handle disputes by using Amiko,” he said. “Others have saved costs by automating dispute management functions, which enabled them to resolve small-ticket disputes that had previously been too expensive to process.”

In a world where 50% of disputes cannot be processed due to incomplete forms or missing information, Amiko’s Virtual Agent optimises dispute management by presenting required information on demand. As a customer’s first touchpoint, the Virtual Agent can also use this data to deflect first-party misuse by providing customers with details that jog their memories and demystify questioned transactions. In fact, an issuer recently told Rivero that only one-third of conversations initiated by the Amiko Virtual Agent resulted in actual dispute cases.

Related articles: