Card Scheme Compliance & Its Importance

One of the core aspects of card payments is to comply with license rules (scheme rules and regulations) of international payment networks (e.g. Mastercard, Visa) and the management of scheme fees and interchange rates. Such responsibility is usually taken care of by a so-called scheme compliance manager or a team of scheme compliance experts, depending on the bank’s size.

As implied by the term, scheme compliance entails a critical responsibility: to avoid non-compliance leading to interoperability issues, non-compliance assessments, and financial losses due to not optimal interchange or scheme fees. In extreme cases, overlooking compliance requirements can cause fines and lead to a loss of the scheme licence for a bank.

Scheme Compliance Process and Related Problems as of Today

Despite the importance of the process, today’s approach is often inefficient, time-consuming and important requirements are easily overlooked.

Manual process: Most scheme compliance managers spend most of their time communicating new rules and requirements to different departments (e.g., via email) and then chase every individual to collect feedback on the compliance status.

High risk of overlooked non-compliance: As a result of a highly manual process, there is a high risk that some requirements or deadlines are missed, the management does not know the compliance status or the compliance status is communicated too late, which all might then result in hefty fines from the payment schemes.

Surprises in schemes fees increases: Schemes fees is another aspect of scheme compliance. In the absence of a well-defined process and tool to control it, scheme compliance teams might discover unwanted surprises in fees they were not aware of.

Lack of overall card compliance overview: As long as the process is handled manually, preparing a comprehensive compliance overview is a highly challenging task that requires constant updates and maintenance of the overview.

Lack of scheme compliance expertise in smaller banks: Many smaller banks do not have a dedicated scheme compliance manager to take care of the process. As a result, it’s either being taken care of by roles such as product manager or project manager. The lack of expertise in such a domain increases, even more, the risk of non-compliance and related fines.

High costs of knowledge lost: As long as the process is handled by a few people with customised excel sheets and tacit knowledge of how to do it, banks run the risk of losing such people. Of course, training new people is possible but would typically take a long time due to the lack of knowledge and well-defined processes and tools.

Scheme Compliance of Tomorrow

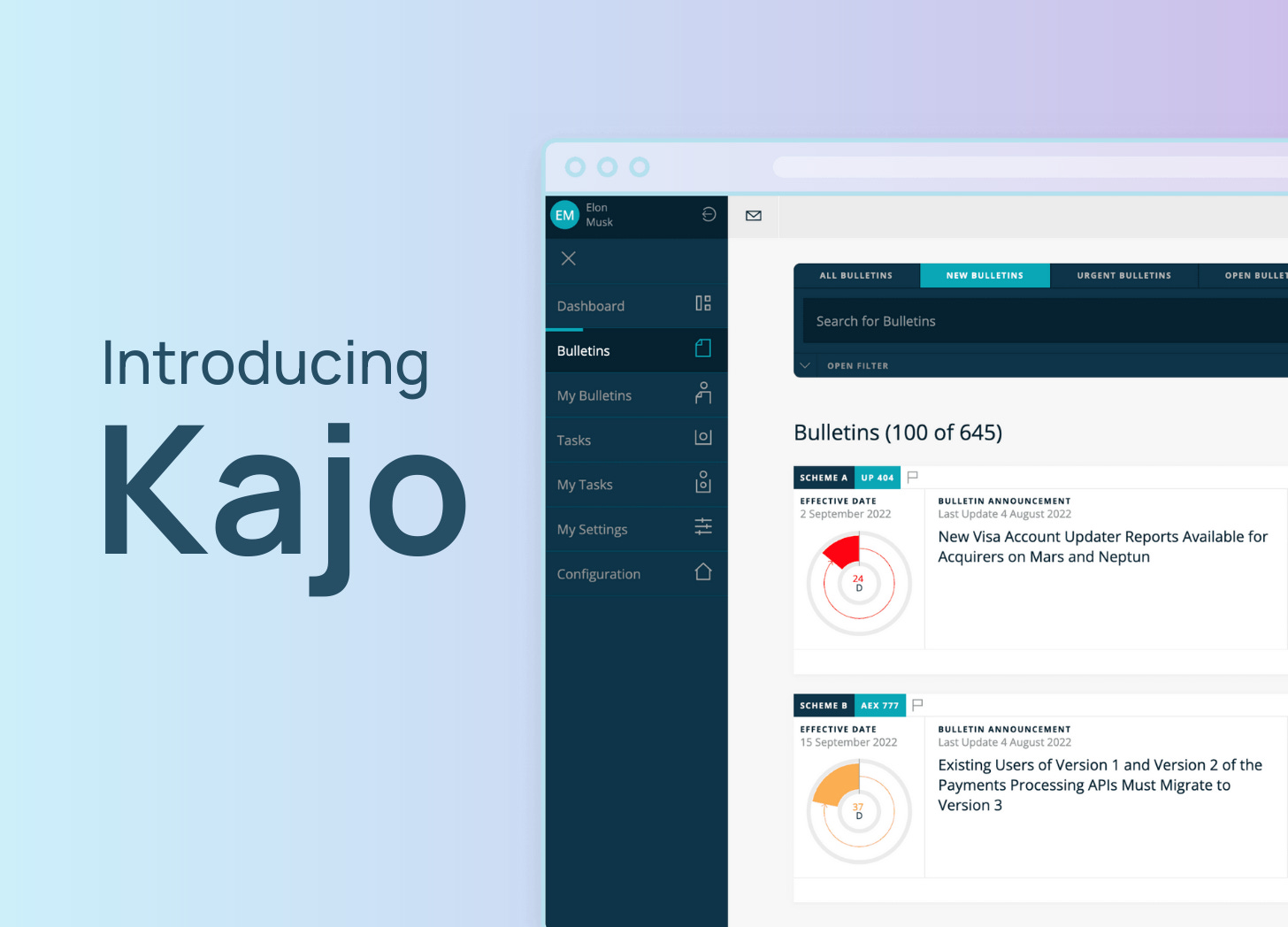

There is vast potential to improve this process in the digitalisation age and gain control over the scheme compliance with minimal efforts. At Rivero, we have done this with our product, kajo, and now enable our customers to do it differently.

Automated process: Most communications can be automated so that the right people will be informed about a new compliance rule or requirements and then provide their feedback on the compliance status and costs in a centralised platform.

Reminders and overview to minimise non-compliance: The platform will send reminders to relevant people to provide feedback on a compliance change. In cases of no feedback, the scheme compliance manager can see the non-compliance or pending topics in a dashboard and take action accordingly.

Gain control over scheme fees and interchange management: Having an overview of scheme fees and changes would enable scheme compliance managers to see where changes in prices occurred and avoid discovering surprises.

Overall card compliance overview: When all the feedback and information are collected on a centralised platform, it is then possible to have an updated overview of the compliance status and fees at any point in time. Besides, such an overview increases transparency in the process and helps uncover the bottlenecks in the process.

Remarks on scheme compliance experts on essential rules: The scheme compliance manager can add their viewpoint on a given rule change for the others to read. Besides, in kajo, scheme compliance experts at Rivero also add remarks on important announcements or bulletins to help the banks with limited resources to interpret the rules more confidently.

Well-documented knowledge and process: Using a well-defined process and tool reduces the risk of losing knowledge when people leave the employer. Also, it facilitates a faster onboarding of new people.

Related articles:

Explore the risks and consequences of breaking card scheme compliance rules

Discover strategies to win over your cardholders, especially during fraud and dispute chargebacks

What issuers need to know about Visa's latest Compelling Evidence 3.0

See firsthand how our SaaS products have fueled success for our clients

Rivero in the news: our latest press releases